How many cement plants are producing in China 2020?

China Cement History

Burning of gypsum and clay for use in mortars came into use in China from 3000–1000 BC. In the time of the Zhou Dynasty, about 700 BC, lime was burnt from mussel shells. These shells contained calcium carbonate, which was transformed during the burning process. Not only was the mortar from this workable and user friendly, but the end product was also highly resistant to moisture and water.

This technology was utilized in the building of grave chambers from the time of the Zhou Dynasty to that of the Ming Dynasty. In “Tian Gong Kai Wu” (Heavenly creations), a very famous book about technology in ancient China, written in the seventeenth century, very detailed descriptions can be found about the process of burning lime.

Recent Chinese studies indicate that burnt lime has been used in China for 5000 years. Lime mortar walls and floors have been found in various structures typical of the culture of the Longshan period along the Yellow River, dating back to about 2800–2300 BC. Using lime was one of the most important measures to strengthen the foundations of ancient building structures. Lime mortar was used as binders in brickwork and as a top mortar in walls and floors. Lime mortar was also used in the Great wall. Work on the geat wall was started in the seventh century BC.

The construction of the Wall went on through 20 dynasties, until the sixteenth century. Of the total 6000–9000 kilometers, about 5000 kilometers were built during the Qin, Han, and Ming dynasties. These dynasties developed lime mortar to a higher technological level and used it in the great wall.

During the Han Dynasty, block work structures with lime mortar were used in a number of areas, among others a pavilion on several floors.

The methods of lime production are described in the book “Tian Gong Kai Wu (Heavenly Creations)” from the Ming Dynasty. Burning of lime has also been described in a document from the Qin Dynasty [Ying Zao Fa Yuan (How to build palace-style stone bridge)].

Sanhetu (Tabia) is a kind of mortar or concrete based on three components: lime, clay, and fine sand. This blend has its origin in the fifth century in South China during the Northern Dynasty period. The other three components that were used were lime, ceramic powder, and crushed rock, or lime, slag, and sand (Qin Dynasty).

In the book “How to build palace-style stone bridge,” belonging to this period, describing Sanhetu, which is made by blending 40% lime and 60% loess with fine sand; this reminds one quite a bit of the “Roman concrete.” This concrete was used in the Qin Dynasty for floors, roofs, foundations and, well compacted, also in dams.

The People’s Republic of China

- The People’s Republic of China (PRC), which spans 9,596,961km2, is the world’s second-largest country by land area, behind Russia.

- With an estimated population of 1.40 billion in 2015, China is the most highly-populated country in the world.

- China is divided into 22 Provinces, five Autonomous Regions, four Municipalities and two Special Administrative Zones.

- Taiwan is China’s ’23rd Province,’ although its status is contested and the region is governed by the Republic of China (ROC).

- China is home to a strong manufacturing industry and the world’s largest cement market.

Cement business role in the China economy

China Cement Industry

At the start of the PRC in 1949, the Chinese cement industry was relatively small with many small cement kilns spread throughout towns and villages. In the 1980s a trend towards large integrated cement plants emerged and several government-owned cement producers were established to raise production. In 2000 the government began to reduce the number of small cement plants on the basis of their inefficiency and high levels of emissions. These efforts are ongoing.

According to the Global Cement Directory 2015, the Chinese cement industry consists of 803 integrated cement plants with a combined production capacity of 1.48 Bnt/yr. There are also 15 cement plants and 28 Mt/yr of cement production capacity in Taiwan. Given the large number of remote cement plants and the lack of independent verification regarding the information supplied by Chinese producers, the data regarding plant numbers and production capacity is incomplete.

Official Chinese cement production statistics reported a 2.3% year-on-year increase to 2.48 Bnt in cement production volumes in 2014. This followed a 9.5% increase in 2013. Clinker production capacity was 2 Bnt/yr in 2014, up from 1.9 Bnt/yr in 2013. In comparison, global cement production in 2014 was 4.18 Bt, while global clinker capacity was 3.57 Bnt/yr. China apparently possessed 59.3% of the world’s cement capacity and 56% of its clinker capacity in 2014.

Suggestions that China has over-reported its cement production volumes have previously been made. However, evidence of unnecessary construction projects has been highlighted in the local media, as has low capacity utilization. The difference in construction industries suggests that China may be accurate in its production statistics, for example, wood is scarce in China, but commonly used in the USA for house-building, so cement consumption will be higher in China even when construction rates are the same.

Cement Plants in CHINA

803 Integrated Cement Plants in China 2020

- The cement industry in China is the largest in the world, producing 2462 Mt in 2014,

- An annual increase of 2.6%.

- China roughly yields 60% of global production of cement.

- In 2017 China produced 2,400,000 metric tons of cement where as other countries produce cement about 1,728,300 metric tons of cement.

The top 20 cement producers in China and Taiwan operate 270 integrated cement plants with a combined production capacity of 861.48 Metric tons/yr. Discounting Taiwan, the top 20 producers have 265 cement plants and 845.1Mt/yr of production capacity. All of the companies are Chinese, with the exception of minority shareholders and Taiwan Cement.

The top 20 cement producers in China (below Table) and Taiwan account for 56.9% of cement production capacity and 33% of cement plants. The disparity in percentages suggests that the top producers operate fewer plants with greater production capacities, in line with China’s trend for consolidation. The remaining 43.1% of cement capacity in China and Taiwan is owned by hundreds of small cement companies, some with capacities as low as 50,000t/yr.

Cement Types production in China

- There are seven types of cement produced in Mainland China, including the P.I 52.5R, the P. II 52.5R, the P. II 42.5R, the P.O 42.5R, the P.O 42.5, the P.C 32.5R, and the P.S.A 32.5 that meet all the local requirements.

The Largest Cement Plants in CHINA- Top 20

The top 20 cement producers in China in 2015 by installed production capacity.

Company | Plants | Capacity (Metric Tons per Year) | |

1 | Anhui Conch | 34 | 219.13 |

2 | CNBM (Sinoma) | 92 | 173.06 |

3 | Taiwan Cement | 6 | 63.72 |

4 | China Resources Cement (CRC) | 16 | 63.12 |

5 | Jidong Development Group | 9 | 36.07 |

6 | Tianrui Group | 11 | 33.08 |

7 | Jiangsu Jinfeng Cement Group | 1 | 30.78 |

8 | Shanshui (Sunnsy) | 15 | 30.46 |

9 | Lafarge Shui On Cement | 23 | 27.69 |

10 | Sichuan Esheng Cement | 2 | 24.99 |

11 | Asia Cement | 6 | 22.95 |

12 | Jilin Yatai Group | 4 | 22.64 |

13 | Huaxin Cement | 11 | 20.26 |

14 | BBMG Corporation | 14 | 19.35 |

15 | Jiangxi Wannianqing Cement | 4 | 16.55 |

16 | Shangfeng Cement Group | 3 | 13.74 |

17 | Fujian Cement | 8 | 13.23 |

18 | Inner Mongolia Mengxi Cement | 6 | 10.48 |

19 | Shandong Quanxing Cement | 1 | 10.31 |

20 | Prosperity Mineral Holdings | 4 | 9.87 |

Total | 270 | 861.48 |

- Source: Global Cement Directory 2015.

- Note: Includes 5.78 Mt/yr (two plants) Asia Cement capacity in Taiwan and 10.6 Mt/yr (three plants) Taiwan Cement capacity in Taiwan.

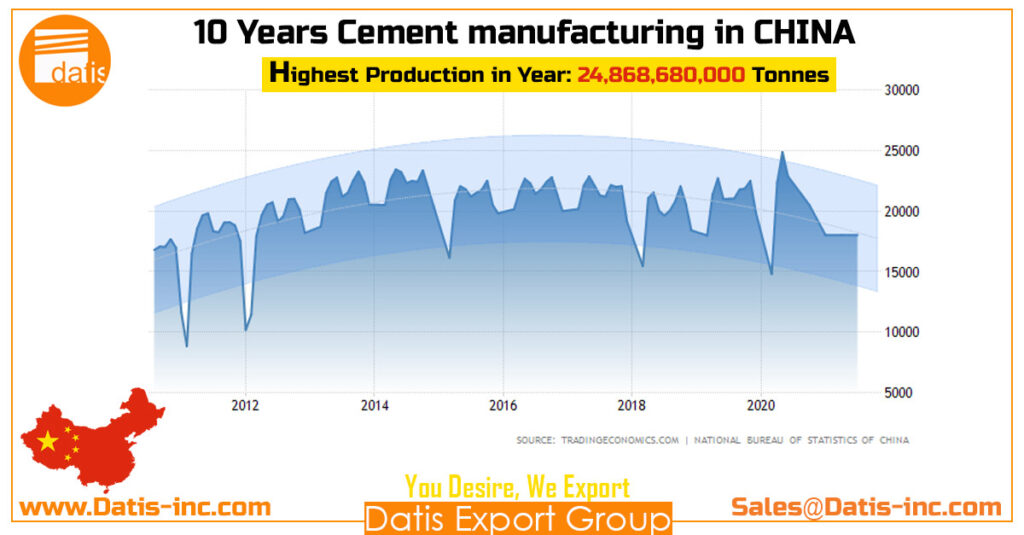

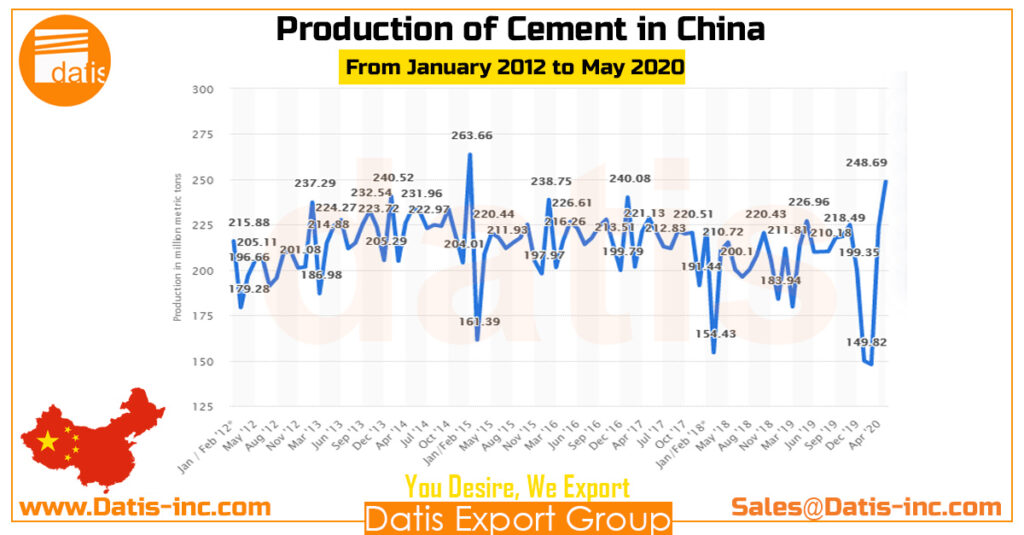

Cement production volume in China for the fiscal year 2012 to 2020

The Largest Cement producer in China

Anhui Conch

Anhui Conch is the China’s largest cement producer at 219.3 million tons of cement capacity per year from its 34 plants.

Anhui Conch Cement Co., Ltd known also as Anhui Conch or Conch Cement, is the largest cement manufacturer or seller in the mainland China, headquartered in Anhui Province. Its business scope covers the manufacture and sales of cement and clinker.

Its H-share was listed on the Hong Kong Stock Exchange on October 21, 1997, while its A-share was listed on the Shanghai Stock Exchange on February 7, 2002.

In 2014, the company’s revenue 99.5% YoY to $9.95 billion, with their net profit growing 16.9% to $9.49 billion; also helping the company’s subsidiaries reach record highs.

The Foshan subsidiary saw sales exceed $10,000,000 per day for five consecutive days in September 2014, with sales then averaging out to $8,000,000 per day. In the near future, Anhui is expecting to expand its reach through further acquisitions and overseas projects.

- Stock price: AHCHF (OTCMKTS) $7.72 -0.13 (-1.68%)

Aug 7, 2020, 4:00 PM EDT - Headquarters: Wuhu, China

- Founded: September 1, 1997

- Area served: China

- Key people: Chairman: Mr. Guo Wensan

About Anhui Conch

- Based on Anhui CONCH website

Anhui Conch Cement Co., Ltd. was established on September 1, 1997 and listed on the market in Hong Kong on October 21, 1997, creating a precedent for the overseas listing of the Chinese cement industry. The company is mainly engaged in the production and sales of cement and commodity clinker.

After years of rapid development, the company’s production capacity continues to grow, the level of process technology and equipment continues to increase, and the development area continues to expand. The company has built five large-scale clinker bases of 10 million tons in Tongling, Yingde, Chizhou, Fuyang and Wuhu, and built four 12,000-ton production lines in Wuhu and Tongling, Anhui.

Conch cement products are of high quality and are well-known throughout the country and exported to overseas.

More than 140 subsidiaries are located in provincial bases and 14 regions, spanning 18 provinces, municipalities and autonomous regions in East China, South China and the West, and Indonesia and Myanmar.

Countries such as Laos and Cambodia have formed a new management and management system of group management, internationalization and regionalization, which has earned the reputation of “World Cement sees China, China Cement sees Conch”.

Website: http://www.conch.cn

CHINA Cement production

First Largest Producer of the World

The cement industry in China is the largest in the world, producing 2.462 Billion Metric Tons in 2014.

In 2017 China produced 2.400 Billion Metric Tons of cement where as other countries produce cement about 1.728 Billion Metric Tons of cement.

Cement Production Capacity and Number of Plants in Chinese Provinces

- The cement production capacity and number of plants in Chinese Provinces, Municipalities, Autonomous Regions and Special Administrative Zones in 2015

| No | Region | Plants | Capacity (Mt/yr) |

| 1 | Anhui Province | 34 | 195 |

| 2 | Beijing Municipality | 6 | 4.68 |

| 3 | Chongqing Municipality | 19 | 30.0 |

| 4 | Fujian Province | 17 | 26.0 |

| 5 | Gansu Province | 26 | 19.6 |

| 6 | Guangdong Province | 27 | 71.3 |

| 7 | Guangxi Zhuang Autonomous Region | 37 | 107 |

| 8 | Guizhou Province | 28 | 19.0 |

| 9 | Hainan Province | 7 | 12.3 |

| 10 | Hebei Province | 21 | 58.5 |

| 11 | Heilongjiang Province | 13 | 12.0 |

| 12 | Henan Province | 47 | 83.9 |

| 13 | Hong Kong Special Administrative Zone | 0 | 0.00 |

| 14 | Hubei Province | 29 | 46.9 |

| 15 | Hunan Province | 30 | 55.6 |

| 16 | Inner Mongolia Autonomous Region | 15 | 20.2 |

| 17 | Jiangsu Province | 23 | 71.3 |

| 18 | Jiangxi Province | 27 | 56.2 |

| 19 | Jilin Province | 11 | 21.6 |

| 20 | Liaoning Province | 24 | 45.7 |

| 21 | Macau Special Administrative Zone | 0 | 0.00 |

| 22 | Ningxia Hui Autonomous Region | 15 | 12.1 |

| 23 | Qinghai Province | 10 | 4.74 |

| 24 | Shaanxi Province | 63 | 37.2 |

| 25 | Shandong Province | 43 | 79.4 |

| 26 | Shanghai Municipality | 3 | 1.56 |

| 27 | Shanxi Province | 11 | 13.1 |

| 28 | Sichuan Province | 81 | 93.1 |

| 29 | Tianjin Municipality | 1 | 1.56 |

| 30 | Tibet Autonomous Region | 9 | 2.38 |

| 31 | Xinjiang Uyghur Autonomous Region | 18 | 8.78 |

| 32 | Yunnan Province | 53 | 31.5 |

| 33 | Zhejiang Province | 54 | 97.6 |

| Total | 802 | 1339.44 | |

| xx | Taiwan | 15 | 28.0 |

- Source: Global Cement Directory 2015

The future of the Cement business in China

Economic and Industry Forecast

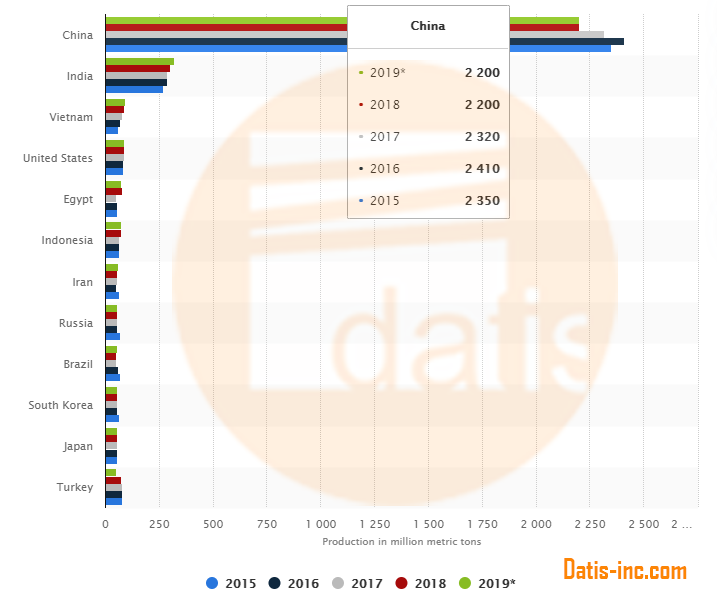

China produces the most cement globally by a large margin, at an estimated 2.2 billion metric tons in 2019, followed by India at 320 million metric tons in the same year.

China currently produces over half of the world’s cement. Global cement production is expected to increase from 3.27 billion metric tons in 2010 to 4.83 billion metric tons in 2030. In China, the cement production in 2018 amounted to some 2.17 million metric tons.

Cement is used to bind the material together and is categorized as either non-hydraulic or hydraulic. Hydraulic cements are composed of silicates and oxides that can set and harden even when exposed to water.

Cement today is mostly used as stucco for buildings in wet climates, as mortar for applications near sea water, and as part of developments for strong concretes.

The road ahead in China’s Cement Industry

Cement Production in China is expected to be 20500.00 Ten Thousands of Tonnes by the end of this quarter (2020), according to Trading Economics global macro models and analysts expectations. Looking forward, we estimate Cement Production in China to stand at 18000.00 in 12 months time. In the long-term, the China Cement Production is projected to trend around 19000.00 Ten Thousands of Tonnes in 2021, according to our econometric models.

China-The cement leader

As a common construction material that is used to bind other materials together, cement belongs to the essential materials that make modern life possible. Few construction projects can take place without the use of cement. Cement is especially important for fast-growing economies. Since 2000, China’s cement production had experienced a remarkable growth. In 2010, the second-largest economy in the world accounted for more than half of global cement production. China has by far the largest cement industry in the world.

China-The driving forces

The explosive growth in cement production correlates with China’s economic expansion. While industrialization and urbanization advanced in the country, the demand of cement rose sharply. According to the National Bureau of Statistics of China, the net output of the construction industry grew constantly in the previous decade. Houses, roads and bridges had been built here with phenomenal speed over the past three decades.

China-Infrastructure is the key

Since extensive roads and railways are indispensable for a modern economy, installing and upgrading physical infrastructure were intensive in China. Over the last decade, the total length of public roads in China was expanding gradually. A major benefit, particularly in rural areas, has been the modernization of domestic transportation infrastructure. To counteract sluggish economic growth, Chinese local and central government also boosted public investment in infrastructure.

During the first five months in 2020, China produced about 768.8 million metric tons of cement, around 8.2 percent lower compared with the same period last year.

FOB Prices for Clinker, Grey Cement, and White Cement/ per MT

Cement Clinker

$19

Portland Cement Clinker-Type II

Status: Fresh, and High-Quality

Standard: ASTM C-150

Delivery: FOB-BIK Port

Payment Terms: TT

Grey Cement

$36

Grey Cement-Type II

Status: Fresh, and High-Quality

Standard: ASTM C 150- Type II

Delivery: FOB-BIK Port

Payment Terms: TT

White Cement

$61

Portland White Cement-52,5

Status: Fresh, and High-Quality

Standard: EN 197-1, 52,5

Delivery: FOB-BND Port

Payment Terms: TT

Gypsum

Rock

$8

GYPSUM rock

Status: High-Quality

Standard: Purity 90-95%

Delivery: FOB-BND Port

Payment Terms: TT

CIF offer

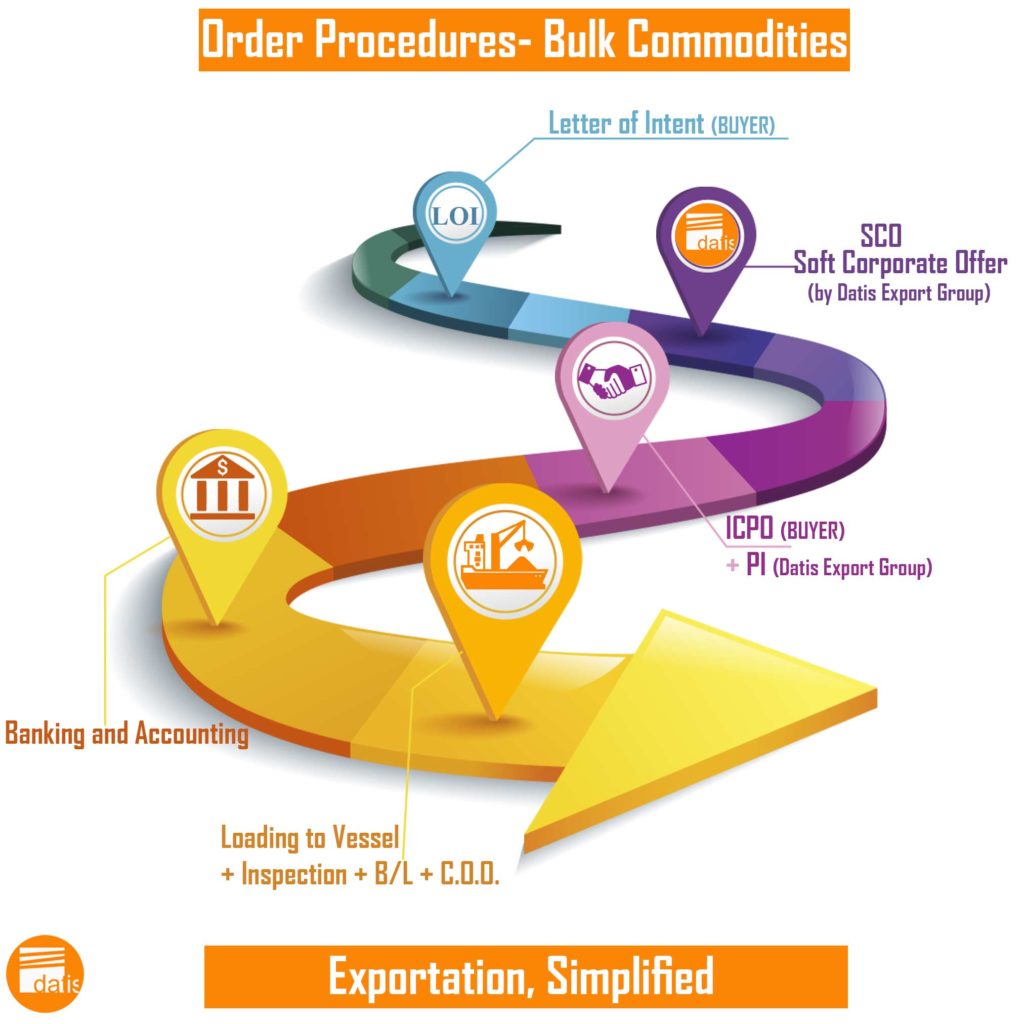

Letter of Intent-LOI in the first level

For CIF offer, our sales team should determine all details such as the product cost, transit to the port of loading, loading to the vessel (or stuffing), customs duties, etc.

we require to obtain accurate information on the inquiry as Letter of Intent-LOI in the first level. Please mail us LOI to our Sales Team.

We hope you find detailed information about the answer to the question of How many cement plants are producing in CHINA 2020 in this article.

Datis Export Group supplies all types of Portland Cement (Grey, and White) and Cement Clinker. Our sales team will manage to export the Cement to any destination port for Bulk and Bagged containerized cargoes.

You can send us your cement inquiry by email to our sales office. Our branches will manage to supply and export the cement through the best-reputed cement factories in the region.