How many cement plants are producing in the USA 2020?

History and Development of Portland Cement in the United States

In the spring of 1866, David O. Saylor, Esias Rehrig, and Adam Woolever started the Coplay Cement Company. The Coplay Cement Company was located along the west side of the Lehigh River and along side of the Lehigh Valley Railroad (L.V.R.R). Early in the 1870’s, Sailor began to experiment with the manufacturing of portland cement from rocks from his own quarry.

With this experimentation, Saylor discovered the possibility of making portland cement from raw materials at his disposal. He noticed that the harder burned portions of his Rosendale clinker produced cement that would show a tensile strength equal to that of the best imported portland cement, for a short period of time. However the cement had the problem of crumbling away with time. This problem was do to the raw materials not being properly proportioned.

Up until this experimentation, the trio of men manufactured natural rock cement. There were many other manufacturers of natural rock cement in the United States at this time. The Rosendale cement of New York had been on the market for over thirty years and manufacturers were already in operation on the Potomac, James, and Ohio River Valleys. Natural rock cements were made by driving off the carbonic acid from argillaceous (clay-bearing) limestones.

This was done at low temperatures in an ordinary upright kiln from 1,000 to 1,200 degrees Fahrenheit, and produced a soft yellow stone. This yellow stone was then ground into a powder and constituted the finished product. On the other hand, portland cement is an artificial mixture of raw materials, has a calcination at a temperature above 2,000 degrees Fahrenheit, and purer raw materials were used than necessary for natural cements.

The raw materials used in the manufacturing of portland cement at this time were cement rock, limestone, shale, and coal. At this period in time, portland cements were not available in the United States, and were imported from England and Germany.

The Lehigh deposits were very much different than those commonly used in Europe, but still were thought to be of suitable and sufficient purity for the manufacturing of portland cement. The deposits in this area were a natural mixture of carbonate of lime and clay in proportions approximating those required for the portland cement mixture. To the southeast of this area, the rocks and limestone were unfit for cement making, and to the northwest there was an abundance of shales and slates.

These deposits proved to be suitable, and Saylor turned out the first portland cement in 1875. In 1876, Saylor’s brand of cement received a medal for highest quality at the Centennial Exhibition in Philadelphia. The rocks used to produce this cement were taken from a quarry near the plant, and had variations in the composition of the rock at different strata. This meant that frequent changes were required to proportion the mixture correctly. Chemists determined these proportions several times daily.

In 1878, the plant had seven kilns for portland cement, producing 2,500 barrels per month. In 1893 a continuous kiln was built for experimental purposes. This kiln was charged with raw materials at the top, and clinker was drawn from the bottom day and night for months. The only time the fire stopped was for repairs. As of 1900, the Coplay cement plant, using continuous kilns, had a maximum production of 500 barrels of portland cement per day.

Before the raw materials reach the kiln, cement rock and limestone are wetted, crushed, and weighed separately. The cement rock and limestone were then discharged together when the weight proportions were right to produce a thoroughly homogeneous mixture so that chemical action between particles could take place. These two rocks were then mixed together and natural cement added to give the mixture a necessary plasticity. This mixture was then made into lumps or balls suitable for charging in a furnace or kiln.

All of these processes took place in the raw materials mill. These balls were then sent to the tunnel dryers where they became free from moisture. These balls were then elevated to the upper or charging floor of the continuous kiln.

This dried slurry was then charged through the doors on the top floor. All the while, the kiln was constantly kept full up to this point. The fuel was introduced through the stoke holes on the floor below. The long vertical shaft, the upper part of the kiln, served as a pre-heater for the bricks, or balls. The narrow section in the middle was a combustion chamber, or crucible, and the lower section cooled the clinker and heated the current of air.

This draft of air from below was heated by passing over the hot clinker before it reached the combustion chamber. The products of combustion heated the balls to a high temperature before they reached the fire. These kilns used gas coal for fuel and proved to be very economical because all of the heat was utilized.

The clinker arrived at the grate below, which was six feet above the lower floor, nearly cold. The burnt clinker is withdrawn form the corners of the kilns at regular intervals into wagons and these contents are weighed. The wagons were drawn up an incline by a cable to the second floor of the cement mill. Here the clinker was stored until it was needed on the first floor where it was ground and packaged.

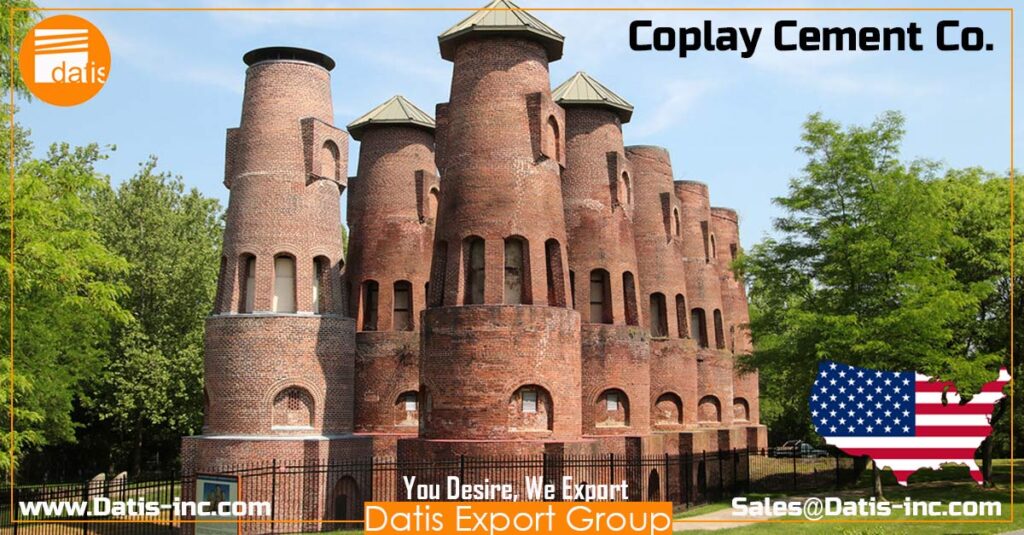

These vertical kilns of the mill B still stand today serving as the David O. Saylor Cement Museum. In 1976, Coplay Cement was aquired by the Essroc Company which still produces Saylor’s portland cement today. Many portland cement plants still exists in the Lehigh Valley today including: Essroc I and Essroc III located in Nazareth, Hercules Cement located in Stockertown, Keystone Cement located in Bath, Allentown Cement located in Evansville, and Whitehall Cement located in Cementon.

- Information compiled by John Harakal

Video Clips about the Coplay Cement Co

The first cement plant in the United States

Coplay Cement Company

From 1893 to 1904 the nine vertical kilns of the Coplay Cement Company were used for the production of portland cement. Built as an improvement in kiln technology over the bottle or dome kiln then in use, the 90 foot high vertical kilns had the advantage of producing a higher quality product than dome kilns and produced it on a continuous basis as well.

However, they were almost immediately superseded by rotary kiln technology that required very little labor to operate. In 1904 the company shut down its vertical kilns and in the 1920s demolished the surrounding buildings and removed the upper 30 feet of the kilns. Lehigh County acquired the kilns in 1976 and launched a rehabilitation campaign. The restored and stabilized kilns now house a cement industry museum.

Not only do these structures represent the transition in kiln technology from the bottle or dome kiln to the rotary kiln, but they stand as a fitting monument to the pioneering role of David O. Saylor, the Coplay Cement Company, and the Lehigh Valley area in the development of the American portland cement industry.

Several years before he constructed his first cement plant in 1866, Saylor purchased the land where it and the future mills of the Coplay Cement Company would be located. His first mill, often referred to as plant A, where he made his first portland cement in 1871, was utilized well into the 1890s but was demolished early in the 20th century. In 1892, eight years after Saylor’s death, the Coplay management, faced with a growing demand for its product, decided to erect a new mill, and eventually 11 Schoefer kilns, which were a Danish modification of an upright kiln originally developed in Germany were built.

Constructed of locally made red brick, these kilns were utilized for the production of portland cement. By 1900 this region provided the nation with 75 percent of its cement and had been the scene of a number of technological breakthroughs like the development of the rotary kiln.

In the long run, this growth, which was made possible by Saylor and his company, enabled the United States to become the world’s leading producer of cement, manufacturing by the 1920s four times as much as Great Britain, its nearest competitor.

The Coplay Cement Company Kilns are located on North Second St., in Coplay.

The area is now a Saylor Park, owned by Lehigh County it is an open-air museum.

The United States of America

Introduction

The United States of America is a federal constitutional republic that stretches from the Atlantic to Pacific Oceans across the continent of North America. It has borders with Canada to the north and Mexico to the southwest.

The 48 contiguous states (and the District of Columbia) stretch for more than 3000km east to west and 2700km north to south. The state of Hawaii consists of an island chain in the Pacific Ocean and Alaska, the largest state, is separated from the contiguous states by western Canada.

The country is the third most populous in the world, although historical factors and its varied terrain means that the population is very unevenly distributed.

With European settlers originally coming to the fertile and temperate plains in the north and east of the country, the first US cities were established on or near to the east coast. These have since been developed extensively. The Mississippi River system, which stretches throughout the east and south east, aided early movement into the area now known as the midwest.

The western states, in contrast, are sparsely populated, especially in the north. A combination of mountains and deserts made early exploration here difficult. Exceptions to this rule include Washington, California and Hawaii.

History

The land that comprises the USA was ‘discovered’ by Christopher Columbus in 1492, although the USA itself was not formed until the signing of the Declaration of Independence on 4 July 1776. Prior to 1776, the eastern side of the modern US territory had been under the control of the British, who had fought with France, Spain and other colonial powers for control of the ‘new world’.

Based in the east of the current USA, the 13 original states acquired land slowly-but-surely across the rest of central North America by the mid-1800s. The most notable acquisitions included the Louisiana Purchase of 1803 (from France), the Mexican Cession of 1819 (from Mexico) and the annexation of Texas, which was an independent republic until 1845.

The most notable period of unrest was the Civil War. In 1861 11 states in the south east of the country attempted to leave the Union in a dispute with President Lincoln over the abolition of slavery. The war was fought mainly in the southern states as the north looked to regain control, something that it achieved in 1865 after four years of bloody conflict.

A late-entry to both the First World War and to the Second World Wars, (following the Japanese attack on Pearl Harbor in Hawaii), the US provided a decisive boost to Allied forces in both conflicts.

The USA’s longest conflict to date was the Cold War with the USSR, the defining backdrop to the second half of the 20th Century. This unconventional conflict saw both sides fight to contain one another’s ideology through a variety of means. These included a mixture of military strategy, an arms race, espionage, the provision of aid to venerable allies and proxy wars in Afghanistan, Korea and Vietnam, until the collapse of the USSR in 1991.

The country’s longest conventional war to date is the ongoing conflict in Afghanistan.

Cement business role in the USA economy

USA, Cement Industry

The US economy is the largest in the world with GDP of over US$ 15 tn in 2011, although the country ranks behind a small number of developed nations in terms of GDP/capita.

The US has a service-based economy (77% in 2011) with an historical emphasis on production and manufacturing, particularly of oil/gas, vehicles, domestic appliances and high-end electronics. Despite taking up 22% of the economy and maintaining a steady contribution to the US economy from the 1950s onwards, the labour force engaged in manufacture has dropped by two thirds in 60 years, from 33% of employees in 1947 to around 10% in 2009.

This decline, the result of improved technology, higher efficiency and the importation of cheaper manufactured goods from the Far East, has left some areas, notably in the north east and New England, with high unemployment and social deprivation.

A switch to modern and more high-tech research and manufacturing has only partly helped the situation, especially in cities like Detroit, nicknamed Motor City, and Motown in the 1950s and 1960s due to the prevalence of the motor industry. While the city still hosts the worldwide headquarters for General Motors, it also reported unemployment of 20% in May 2011.

The US cement industry is one of the largest in the world, with an estimated installed capacity over 100Mt/yr. The 2012 edition of the Global Cement Directory puts the country third in terms of active and mothballed capacity (>113Mt/yr), behind China (>1400Mt/yr) and India (>230Mt/yr).

Its rise to this position started in the second quarter of the 19th Century, with the introduction of intermittent and continuous shaft kilns in the areas surrounding New York city. In 1825 the Erie Canal, between Buffalo to Lake Erie, an ambitious 584km-long construction project, was completed. Its construction was in large part thanks to recently discovered ‘meagre lime’ in the area.

An increasing number of limestone discoveries in the east and the ease of transport along the Mississippi River system in the Midwest led to the rapid establishment of a cement industry. Much of the industry is still concentrated in this area, with 25% of US cement being involved in some way with the system.

GDP (2011 est.) | US$ 1,504 bn |

GDP/capita (Est.) | US$ 47,955 |

Population (2012 Est.) | 313.8 m |

Area | 9,826,675 km2 |

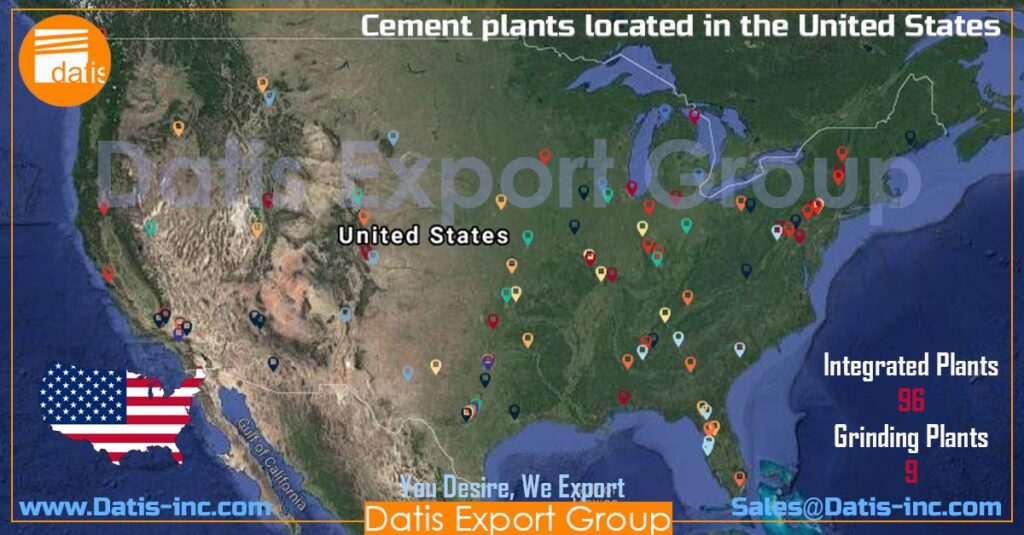

Integrated cement plants | 97 |

Integrated capacity | 114.7 Mt/yr |

Mothballed capacity | 6.8 Mt/yr |

- Above Table: Summary data for the United States of America and its cement industry.

The US Cement -Rotary revolution in the United States

It was in the early 1900s, however, that cement production really took off in the US, with the introduction of the rotary kiln. As early as 1900 there are accounts of the Lehigh Valley having 29 rotary kilns, which, though small by modern standards, each produced at more than twice the rate of previous methods. Incremental improvements led to higher and higher outputs, with the industry experimenting with preheaters and precalciners from the 1950s onwards and increasingly sophisticated automated production since then.

The industry has been overseen for the majority of its existence by a nationwide association, first known as the Association of American Portland Cement Manufacturers (AAPCM). The AAPCM was formed in 1902 to safeguard the interests of the industry. It was renamed the Portland Cement Association (PCA).

The US Cement – 2005 to 2011

Despite its high modern capacity, the cement industry in the US is currently operating well below its headline figures. The PCA reports that in 2005, before the onset of the current fiscal problems, the US consumed approximately 122Mt of cement.

In 2006 this value held steady at 122Mt, in 2007 it dropped to 110Mt and in 2008 it fell to 93Mt. Even worse consumption was seen in 2009 and 2010, when the country consumed just 67-68Mt, nearly half of the level just five years previously. This represented a capacity-utilisation rate of just 67%.

The extent of the damage inflicted by the current economic downturn on the US cement industry can be seen by looking at cement consumption statistics from 2005, the peak of US cement demand, and 2010. Please refer to the tables below.

Over these five years 48 out of the 50 US States observed a decrease in cement consumption. Most badly affected were Arizona, (-69%), Florida (-68%), Nevada (-68%), Georgia (-61%) and California (-60%).

In terms of raw figures, Florida appears to be the worst affected state. Its drop in consumption coincided with a capacity increase from 5.1Mt/yr in 2005 up to 9Mt/yr in 2010!

In addition to the states in the ‘over 60%’ bracket, a further 23 states; Alabama, Colorado, Connecticut, the District of Columbia, Hawaii, Idaho, Illinois, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Mississippi, New Hampshire, New Jersey, North Carolina, Ohio, Oregon, Washington, Rhode Island, South Carolina, Tennessee and Virginia, saw drops of 40% or more.

Notable among these is Missouri, which, like Florida, saw its installed capacity increase massively in the middle of 2009 with the arrival of Holcim’s 4Mt/yr Ste. Genevieve plant on the Mississippi River.

Many other states saw decreases well into double-digits over the same period, with only two states seeing a net increase in cement consumption over the same time period. These were Louisiana, where consumption increased by over a quarter, and North Dakota, where consumption was up by 17%, albeit at a low level.

Neither of these states has its own integrated cement plant and their combined consumption in 2010 was 3.15Mt, just 4.5% of the total consumption in the US in 2010. The only state to come out of the analysis relatively unscathed is South Dakota, one of the least populated states in the country, with an apparent drop in consumption of 6% between 2005 and 2010.

In 2011 cement consumption was again low at just 66Mt, still far down on the record production levels seen in 2005. Of the 50 US states, the top seven producers (in desending order by volume: Texas, California, Missouri, Florida, Pennsylvania, Michigan and Alabama) accounted for 53% of total US cement production for the year.

Cement consumption for US states and D.C. in 2005 and 2010 and net percentage change

| State | Consumption (Mt) | Change (%) | |

| 2005 | 2010 | ||

| Alabama | 1.74 | 1 | -42 |

| Alaska | 0.17 | 0.14 | -18 |

| Arizona | 4.67 | 1.47 | -69 |

| Arkansas | 1.21 | 0.76 | -37 |

| California | 15.32 | 6.16 | -60 |

| Colorado | 2.52 | 1.47 | -42 |

| Connecticut | 0.8 | 0.47 | -41 |

| Delaware | 0.21 | 0.17 | -19 |

| District of Columbia | 0.21 | 0.11 | -48 |

| Florida | 11.22 | 3.62 | -68 |

| Georgia | 4.39 | 1.72 | -61 |

| Hawaii | 0.43 | 0.26 | -40 |

| Idaho | 0.7 | 0.39 | -44 |

| Illinois | 4.54 | 2.43 | -46 |

| Indiana | 2.18 | 1.48 | -32 |

| Iowa | 1.93 | 1.43 | -26 |

| Kansas | 1.54 | 1.17 | -24 |

| Kentucky | 1.49 | 0.85 | -43 |

| Louisiana | 2.17 | 2.74 | 26 |

| Maine | 0.35 | 0.19 | -46 |

| Maryland | 1.57 | 0.97 | -38 |

| Massachusetts | 1.24 | 0.68 | -45 |

| Michigan | 2.92 | 1.55 | -47 |

| Minnesota | 2.02 | 1.2 | -41 |

| Mississippi | 1.07 | 0.77 | -28 |

| Missouri | 2.82 | 1.56 | -45 |

| Montana | 0.38 | 0.26 | -32 |

| Nevada | 2.6 | 0.83 | -68 |

| Nebraska | 1.36 | 0.99 | -27 |

| New Hampshire | 0.37 | 0.19 | -49 |

| New Jersey | 1.97 | 1.12 | -43 |

| New Mexico | 0.9 | 0.6 | -33 |

| New York | 3.15 | 2.3 | -27 |

| North Carolina | 2.9 | 1.58 | -46 |

| North Dakota | 0.35 | 0.41 | 17 |

| Ohio | 3.89 | 2.35 | -40 |

| Oklahoma | 1.6 | 1.43 | -11 |

| Oregon | 1.24 | 0.61 | -51 |

| Pennsylvania | 3.31 | 2.41 | -27 |

| Rhode Island | 0.19 | 0.09 | -53 |

| South Carolina | 1.78 | 0.93 | -48 |

| South Dakota | 0.48 | 0.45 | -6 |

| Tennessee | 2.24 | 1.23 | -45 |

| Texas | 14.67 | 10.16 | -31 |

| Utah | 1.53 | 1.02 | -33 |

| Vermont | 0.15 | 0.1 | -33 |

| Virginia | 2.67 | 1.39 | -48 |

| Washington | 2.22 | 1.32 | -41 |

| West Virginia | 0.51 | 0.43 | -16 |

| Wisconsin | 2.35 | 1.43 | -39 |

| Wyoming | 0.47 | 0.32 | -32 |

| UNITED STATES | 122.7 | 68.71 | -44 |

- Cement consumption (Mt) for US states and D.C. in 2005 and 2010 and net percentage change.

The US Cement – Multinationals

Like many countries in the world, the USA has significant amounts of cement produced by the major multinational cement firms, Lafarge, Cemex, Holcim and HeidelbergCement. Between them the big four control around 40% of the integrated cement plants and 48-50% of the operational and mothballed capacity.8 Smaller multinationals like Titan and Buzzi Unicem and homegrown producers like Ash Grove Cement and Texas Industries take up the remaining share of the market.

Cement Plants located in the USA

| No | Group Name | Company Name | Facility Name | City |

| 1 | Aalborg Portland A/S | Lehigh White Cement Company | Waco | Waco |

| 2 | Aalborg Portland A/S | Lehigh White Cement Company | York | York |

| 3 | Armstrong Cement & Supply Corporation | Armstrong Cement & Supply Corporation | Cabot | Cabot |

| 4 | Buzzi Unicem SpA | Alamo Cement Co. | Alamo | San Antonio |

| 5 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Cape Girardeau | Cape Girardeau |

| 6 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Chattanooga | Chattanooga |

| 7 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Festus | Festus |

| 8 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Greencastle | Greencastle |

| 9 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Maryneal | Maryneal |

| 10 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Pryor | Pryor |

| 11 | Buzzi Unicem SpA | Buzzi Unicem USA Inc. | Stockertown | Stockertown |

| 12 | Cementos Argos S.A. | Argos USA Corporation | Atlanta | Atlanta |

| 13 | Cementos Argos S.A. | Argos USA Corporation | Calera | Calera |

| 14 | Cementos Argos S.A. | Argos USA Corporation | Harleyville | Harleyville |

| 15 | Cementos Argos S.A. | Argos USA Corporation | Martinsburg | Martinsburg |

| 16 | Cementos Argos S.A. | Argos USA Corporation | Newberry Plant | Newberry |

| 17 | Cementos Argos S.A. | Argos USA Corporation | Port Manatee Plant | Palmetto |

| 18 | Cementos Argos S.A. | Argos USA Corporation | Tampa Terminal and Grinding Station | Tampa |

| 19 | Cemex | Cemex USA | Balcones Plant | New Braunfels |

| 20 | Cemex | Cemex USA | Brooksville North | Brooksville |

| 21 | Cemex | Cemex USA | Brooksville South Plant | Brooksville |

| 22 | Cemex | Cemex USA | Clinchfield Plant | Clinchfield |

| 23 | Cemex | Cemex USA | Demopolis Plant | Demopolis |

| 24 | Cemex | Cemex USA | Knoxville Plant | Knoxville |

| 25 | Cemex | Cemex USA | Lyons Plant | Longmont |

| 26 | Cemex | Cemex USA | Miami Terminal – Cement Plant | Miami |

| 27 | Cemex | Cemex USA | Victorville Plant | Victorville |

| 28 | Cemex | Cemex USA | Wampum Plant | Wampum |

| 29 | CIMSA Americas Cement Manufacturing & Sales Corp | CIMSA Americas Cement Manufacturing & Sales Corp | CIMSA Houston white | Houston |

| 30 | CRH PLC | Ash Grove Cement Company | Chanute | Chanute |

| 31 | CRH PLC | Ash Grove Cement Company | Durkee | Durkee |

| 32 | CRH PLC | Ash Grove Cement Company | Foreman | Foreman |

| 33 | CRH PLC | Ash Grove Cement Company | Leamington Plant | Leamington |

| 34 | CRH PLC | Ash Grove Cement Company | Louisville | Louisville |

| 35 | CRH PLC | Ash Grove Cement Company | Midlothian | Midlothian |

| 36 | CRH PLC | Ash Grove Cement Company | Montana City | Clancy |

| 37 | CRH PLC | Ash Grove Cement Company | Seattle | Seattle |

| 38 | CRH PLC | Suwannee American Cement | Branford | Branford |

| 39 | CRH PLC | Suwannee American Cement | Sumterville | Sumterville |

| 40 | Eagle Materials Inc. | Central Plains Cement Company | Sugar Creek Cement Plant | Sugar Creek |

| 41 | Eagle Materials Inc. | Central Plains Cement Company | Tulsa Cement Plant | Tulsa |

| 42 | Eagle Materials Inc. | Eagle Materials Inc. | Kosmos Cement – Louisville Plant | Louisville |

| 43 | Eagle Materials Inc. | Fairborn Cement | Fairborn Plant | Fairborn |

| 44 | Eagle Materials Inc. | Illinois Cement Company | LaSalle | LaSalle |

| 45 | Eagle Materials Inc. | Mountain Cement Company | Laramie Plant | Laramie |

| 46 | Eagle Materials Inc. | Nevada Cement Company | Fernley | Fernley |

| 47 | Eagle Materials Inc. | Texas Lehigh Cement Company, LP | Buda | Buda |

| 48 | Elementia, S.A.B. de C.V. | Giant Cement Holding, Inc. | Harleyville | Harleyville |

| 49 | Giant Cement Holding, Inc. | Dragon Products Company | Thomaston | Thomaston |

| 50 | Giant Cement Holding, Inc. | Keystone Cement Company | Bath | Bath |

| 51 | Grupo Cementos de Chihuahua (GCC) | GCC America (GCCA) | Odessa Plant | Odessa |

| 52 | Grupo Cementos de Chihuahua (GCC) | GCC America (GCCA) | Pueblo | Pueblo |

| 53 | Grupo Cementos de Chihuahua (GCC) | GCC America (GCCA) | Rapid City | Rapid City |

| 54 | Grupo Cementos de Chihuahua (GCC) | GCC America (GCCA) | Rio Grande – Tijeras | Tijeras |

| 55 | Grupo Cementos de Chihuahua (GCC) | GCC America (GCCA) | Trident Plant (Three Forks) | Three Forks |

| 56 | LafargeHolcim Ltd | Holcim (US) Inc. | Ada | Ada |

| 57 | LafargeHolcim Ltd | Holcim (US) Inc. | Devil’s Slide | Morgan |

| 58 | LafargeHolcim Ltd | Holcim (US) Inc. | Hagerstown | Hagerstown |

| 59 | LafargeHolcim Ltd | Holcim (US) Inc. | Midlothian | Midlothian |

| 60 | LafargeHolcim Ltd | Holcim (US) Inc. | Portland Plant | Florence |

| 61 | LafargeHolcim Ltd | Holcim (US) Inc. | Holly Hill | Holly Hill |

| 62 | LafargeHolcim Ltd | Holcim (US) Inc. | Ste Genevieve | Bloomsdale |

| 63 | LafargeHolcim Ltd | Holcim (US) Inc. | Theodore | Theodore |

| 64 | LafargeHolcim Ltd | Lafarge Canada Inc. | Seattle Cement Plant | Seattle |

| 65 | LafargeHolcim Ltd | Lafarge North America Inc | Alpena Cement Plant | Alpena |

| 66 | LafargeHolcim Ltd | Lafarge North America Inc | Joppa Cement Plant | Grand Chain |

| 67 | LafargeHolcim Ltd | Lafarge North America Inc | Paulding Cement Plant | Paulding |

| 68 | LafargeHolcim Ltd | Lafarge North America Inc | Ravena Cement Plant | Ravena |

| 69 | LafargeHolcim Ltd | Lafarge North America Inc | South Chicago Slag Grinding Plant | Chicago |

| 70 | LafargeHolcim Ltd | Lafarge North America Inc | Sparrows Point Slag Granulation and Grinding Plant | Baltimore |

| 71 | LafargeHolcim Ltd | Lafarge North America Inc | Whitehall Cement Plant | Whitehall |

| 72 | Lehigh Hanson, Inc. | Lehigh Cement Company LLC | Logansport | Logansport |

| 73 | Lehigh Hanson, Inc. | Lehigh Cement Company LLC | Nazareth | Nazareth |

| 74 | Lehigh Hanson, Inc. | Lehigh Cement Company LLC | Speed | Speed |

| 75 | Lehigh Hanson, Inc. | Lehigh Northeast Cement Company | Catskill | Catskill |

| 76 | Lehigh Hanson, Inc. | Lehigh Northeast Cement Company | Glenns Falls | Glenns Falls |

| 77 | Lehigh Hanson, Inc. | Lehigh Northwest Cement Company | Bellingham | Bellingham |

| 78 | Lehigh Hanson, Inc. | Lehigh Portland Cement Company | Evansville Plant | Fleetwood |

| 79 | Lehigh Hanson, Inc. | Lehigh Portland Cement Company | Leeds | Leeds |

| 80 | Lehigh Hanson, Inc. | Lehigh Portland Cement Company | Mason City | Mason City |

| 81 | Lehigh Hanson, Inc. | Lehigh Portland Cement Company | Mitchell | Mitchell |

| 82 | Lehigh Hanson, Inc. | Lehigh Portland Cement Company | Union Bridge | Union Bridge |

| 83 | Lehigh Hanson, Inc. | Lehigh Southwest Cement Company | Cupertino | Cupertino |

| 84 | Lehigh Hanson, Inc. | Lehigh Southwest Cement Company | Redding | Redding |

| 85 | Lehigh Hanson, Inc. | Lehigh Southwest Cement Company | Tehachapi | Tehachapi |

| 86 | Martin Marietta Materials, Inc. | Martin Marietta Materials, Inc. | Hunter Plant | New Braunfels |

| 87 | Martin Marietta Materials, Inc. | Martin Marietta Materials, Inc. | Midlothian Plant | Midlothian |

| 88 | Martin Marietta Materials, Inc. | Martin Marietta Materials, Inc. | Riverside Cement – Crestmore Plant White | Riverside |

| 89 | National Cement Group | National Cement Company of Alabama, Inc. | Ragland | Ragland |

| 90 | National Cement Group | National Cement Company of California, Inc. | Lebec | Lebec |

| 91 | Salt River Materials Group | Salt River Materials Group | Phoenix Cement | Clarkdale |

| 92 | St Marys VCNA, LLC | St. Marys Cement | Charlevoix | Charlevoix |

| 93 | St Marys VCNA, LLC | St. Marys Cement | Detroit | Detroit |

| 94 | St Marys VCNA, LLC | St. Marys Cement | Dixon | Dixon |

| 95 | Summit Materials | Continental Cement Company, LLC | Davenport Cement Plant | Buffalo |

| 96 | Summit Materials | Continental Cement Company, LLC | Hannibal Plant | Hannibal |

| 97 | Taiheiyo Cement Corporation | CalPortland Company | Mojave Plant | Mojave |

| 98 | Taiheiyo Cement Corporation | CalPortland Company | Rillito Cement Plant | Rillito |

| 99 | Taiheiyo Cement Corporation | CalPortland Company | Riverside Cement – Oro Grande Plant | Oro Grande |

| 100 | The Monarch Cement Company | The Monarch Cement Company | Humboldt | Humboldt |

- Download the Integrated Cement plants in the USA on the map as a PDF file– by Global Cement Magazine-May 2012

Types of Portland Cement

The flexibility of Portland cement is evident in the different types, which are manufactured to meet various physical and chemical requirements.

The American Society for Testing and Materials (ASTM) Specification C-150 provides for eight individual types of Portland cement.

- Type I – For use when the special properties specified for any other type are not required.

- Type IA – Air-entraining cement for the same uses as Type I, where air-entrainment is desired.

- Type II – For general use, more especially when moderate sulfate resistance is desired.

- Type IIA – Air-entraining cement for the same uses as Type II, where air-entrainment is desired.

- Type II(MH) – For general use, more especially when moderate heat of hydration and moderate sulfate resistance are desired.

- Type II(MH)A – Air-entraining cement for the same uses as Type II(MH), where air-entrainment is desired.

- Type III – For use when high early strength is desired.

- Type IIIA – Air-entraining cement for the same use as Type III, where air-entrainment is desired.

- Type IV – For use when a low heat of hydration is desired.

- Type V – For use when high sulfate resistance is desired.

Video Clips about the Lagarge Holcim and Cemenx Plants in the USA

The Largest Cement Plants in the USA-Top 10

The cement production in the USA is mostly controlled by multinational companies for instance CRH Plc, Cemex, Lafarge Holcim, Lehigh Hanson, Argos USA Corporation, and Buzzi Unicem. Nonetheless, there are few numbers of domestic companies such as Ash Grove Cement and CalPortland Company.

| Company | U.S. Headquarter | Capacity MT/Year | Number of Plants |

| Lafarge Holcim | Chicago, IL | 345.2 | 220 |

2 | Cemex | Houston, TX | 91.6 | 61 |

3 | CRH | Atlanta, GA | 50.5 | 54 |

4 | Buzzi Unicem | Bethlehem, PA | 49.2 | 37 |

5 | Argos USA Corporation | Alpharetta, GA | 18.8 | 15 |

6 | Ash Grove Cement Company | Overland Park, KS | 7.5 | 8 |

7 | Eagle Materials | Dallas, TX | 6 | 17 |

8 | Lehigh Hanson | Irving, TX | — | 19 |

9 | CalPortland Company | Glendora, CA | — | — |

10 | Essroc cement corp | Chicago, IL |

|

|

- Source: theconstructor.org and thomasnet.com

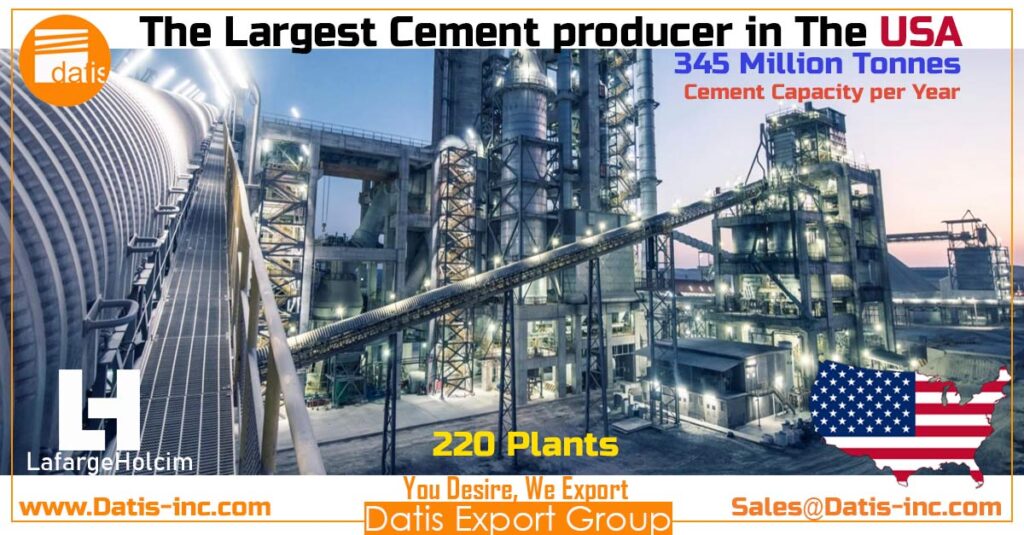

1. Lafarge Holcim

Lafarge Holcim was established in 2015 by combining assets of former multinational producers Lafarge and Holcim. It is reported that, Lafarge Holcim own a total of 220 plants and 345.2Mt/yr of cement capacity; 149 of which are integrated cement plants with a total capacity of 287.3Mt/yr, as well as 57.9Mt/yr of grinding capacity across 71 plants.

https://www.lafargeholcim.com/

2. Cemex

It is a Mexican company which started its operation in the United States in 1994 by acquiring Balcones cement plant. Cemex is one of the greatest cement manufacturer in the world since 2000. However it has suffered significant recession.

The acquisition of Australia’s Rinker Materials increased the market share of the company in the United States considerably.

Cemex own a total of 61 plants; 52 active integrated plants and nine active grinding plants which yields a total of 91.6Mt/yr of cement capacity. It operates 13 plants and 46 cement terminal in the united states. Cemex headquarter based in Houston.

3. CRH Plc.

The North American arm of the Ireland-based CRH plc. CRH established in 1990 and started operations in the USA in 1990. It operates in the entire united states, six Canadian provinces, and other twenty-nine countries.

CRH grew rapidly between 2015 and 2016 due to its acquisition of a range of assets from the merging Lafarge and Holcim. It has 50.5Mt/yr of cement production capacity across 39 integrated and 15 grinding plants. CRH considers itself the largest building materials company in North America. its headquarter in the United States located in Atlanta.

4. Buzzi Unicem

It considered to be one of the leading cement manufacturing companies in the US. Buzzi Unicem established by combining of Buzzi Unicem SpA and Lone Star Industries in 2004. Buzii Unicerm possesses seven cement plants with a production capacity of nearly 9 million metric tons.

The types of cement the company manufacture within the guidelines of ASTM C150 are Type l – normal, general purpose, Type IA – normal, air entrained, Type ll – moderate sulfate resistance, and Type lll – high early strength. The company operates 34 cement terminals across the US to distribute the cement into 21 states.

5. Argos USA Corporation

Argos Cement Company founded in 1936 in Columbia and becomes one of the most significant company in that country. Nonetheless, its operation in the United States started when Southern Star Concrete and Concrete Express in the United States were acquired in 2005.

According to the official website of the company, it has become the fourth largest cement production company in the United States in 2011. In 2015, For the second consecutive year, Argos received distinction and included in the 2014 RobecoSAM Sustainability Yearbook.

6. Ash Grove Cement Company

The company established in 1882, but the first cement production plant opened in 1908. According to the official website of the company, it’s the fifth largest cement production company in the United States. It owns eight cement plants across the united states and 27 cement terminals, in addition to two deep water import terminals.

In 2018, Ash Grove Cement is purchased by CRH Plc. the largest building materials company in North America and the second largest worldwide.

7. Eagle Materials

This cement producer company established in 1960 by opening Nevada cement plant. Eagle Materials’ cement manufacturing facilities are located in Illinois, Missouri, Nevada, Ohio, Oklahoma, Texas, and Wyoming. The latest upgrade and expansion activities increased the production capacity by nearly five million tons per year.

8. Lehigh Hanson

It established as a single mill operation in 1897, producing Portland cement. At the moment, Lehigh Hanson operates as part of Heidelberg Cement. So, the Heidelberg, which is one of the world’s leading producers of cement, established its presence in the United States with the acquisition of the Lehigh Cement Company in 1977.

Lehigh Hanson produces a variety of cement, and owns 19 cement plants and more than 70 distribution terminals strategically located across the United States and Canada. Its headquarters are located in Irving, Texas, United States.

9. CalPortland Company

It was founded in 1891 with the opening of the Colton Plant. CalPortland is recognized as the leader in quality cement production and innovation. It produces several types of cement: for instance Portland cement part I to part V, blended Portland-limestone type IL cement, oil ad well cement glass g, and many more.

The Environmental Protection Agency (EPA) has recognized CalPortland for fourteen consecutive years 2005 – 2018. It has been recognized nationally for energy conservation, emission reduction, recycling, and plant safety. It operates thirteen cement production plant in the USA.

10. Essroc cement corp.

It is founded in 1866 as Coplay Cement Co, and the production of Portland cement started in 1872. The Coplay acquired by Ciments Francais in 1976. Then, the name of the company changed to Essroc cement corp. After that, the Italcementi SpA acquired the Ciments Francais in 1992.

ESSROC Cement Corp. produces cement and offers bulk cement, such as Portland cements and supplementary cementing materials, general purpose cement, slag cement, hydraulic cement, limestone cement, and blast furnace slags.

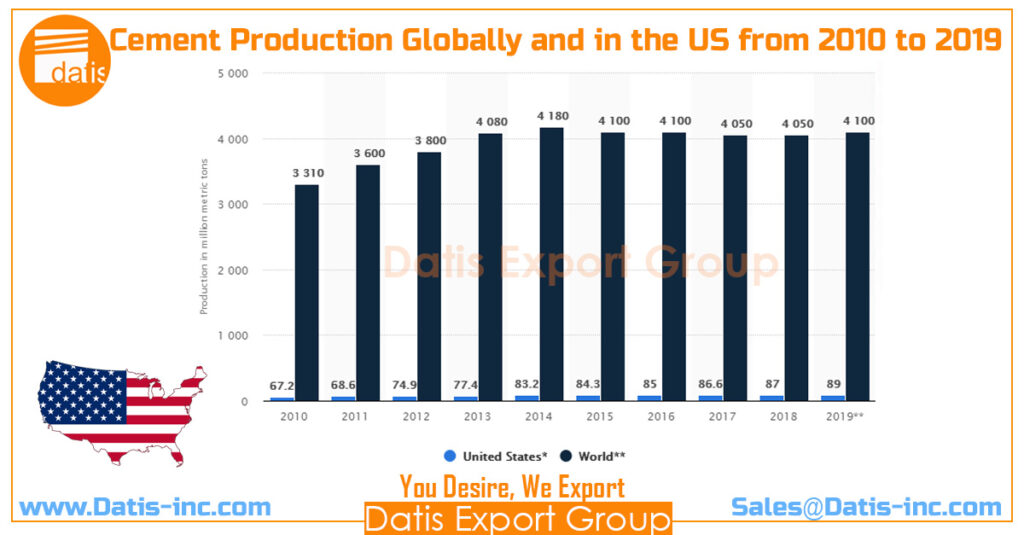

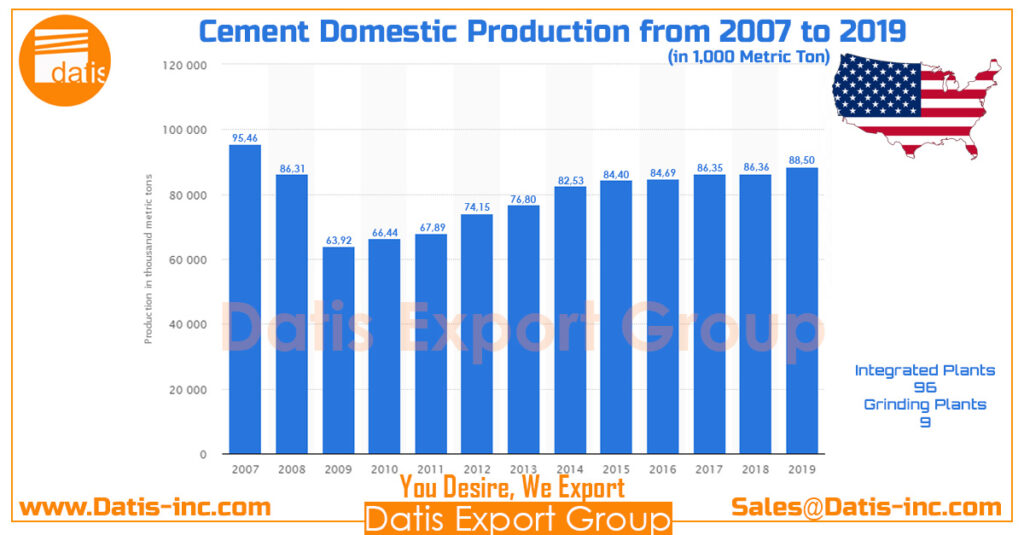

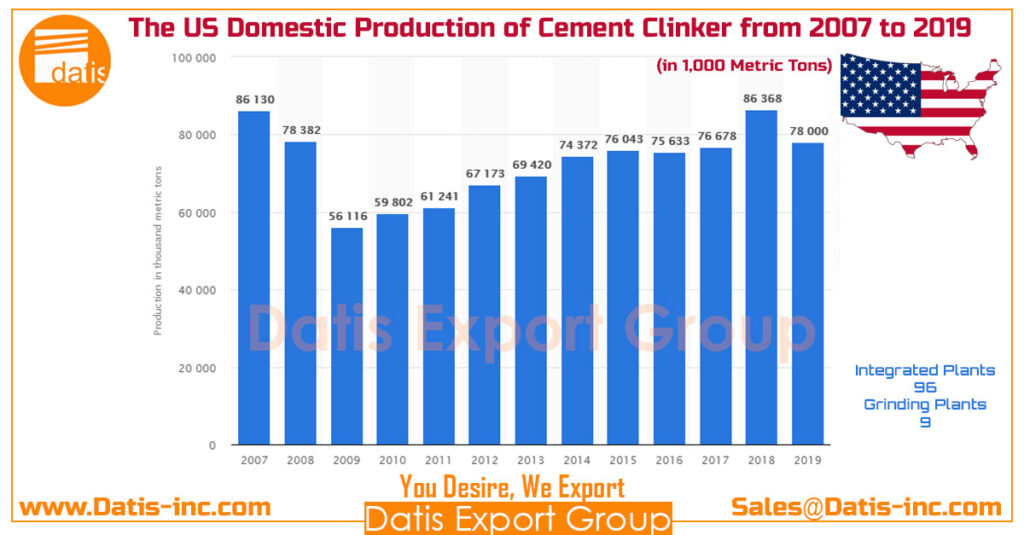

US domestic production of Portland and masonry cement from 2007 to 2019

The Largest Cement producer in the USA

Lafarge Holcim

-

345.2 Metric Tons/ Year Cement Capacity

-

220 Plants

Lafarge Holcim was established in 2015 by combining assets of former multinational producers Lafarge and Holcim. It is reported that, Lafarge Holcim own a total of 220 plants and 345.2Mt/yr of cement capacity; 149 of which are integrated cement plants with a total capacity of 287.3Mt/yr, as well as 57.9Mt/yr of grinding capacity across 71 plants.

https://www.lafargeholcim.com/

The USA Cement production

Fourth Producer of the World

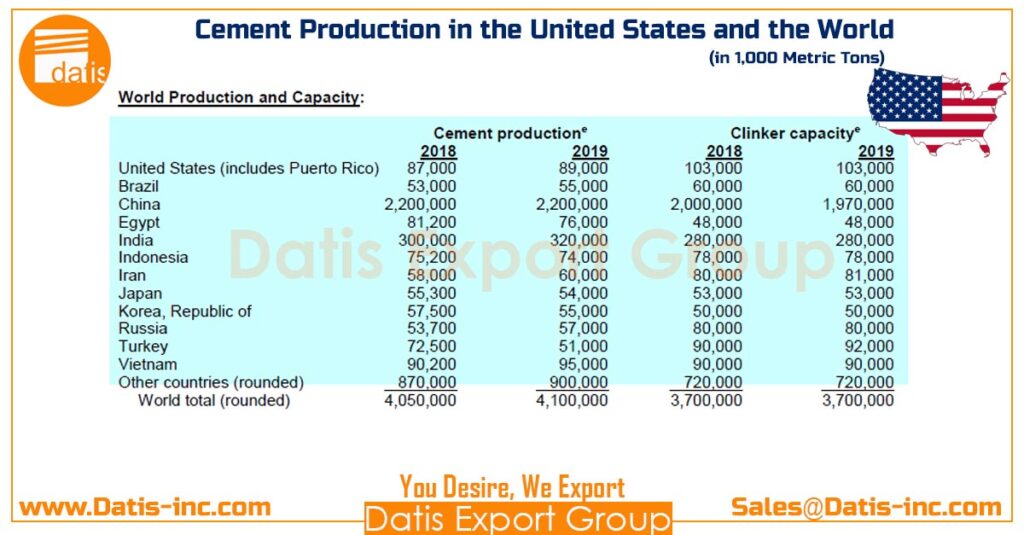

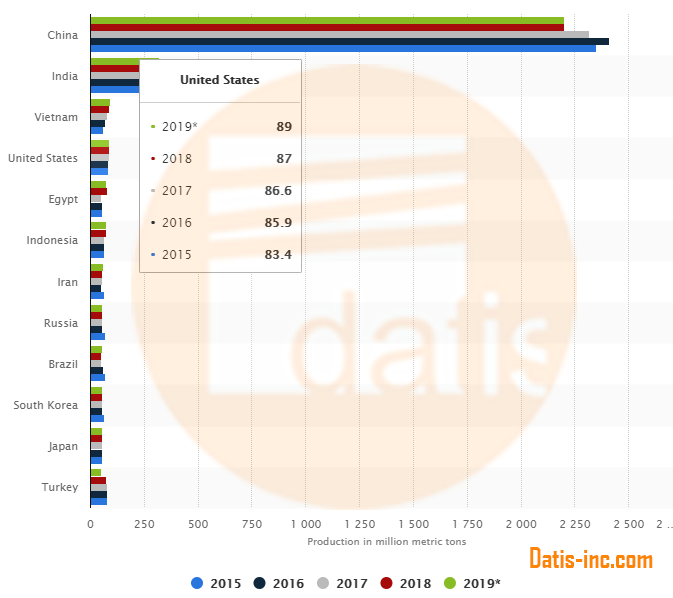

The cement industry in the United States produced 89 million tonnes (89,000,000 tons) of cement in 2019 after China, India and Vietnam, It's 4th rank of the world

The future of the Cement business in the USA

Domestic Production and Use

In 2019, U.S. portland cement production increased by 2.5% to 86 million tons, and masonry cement production continued to remain steady at 2.4 million tons. Cement was produced at 96 plants in 34 States, and at 2 plants in Puerto Rico.

U.S. cement production continued to be limited by closed or idle plants, underutilized capacity at others, production disruptions from plant upgrades, and relatively inexpensive imports. In 2019, sales of cement increased slightly and were valued at $12.5 billion. Most cement sales were to make concrete, worth at least $65 billion.

In 2019, it was estimated that 70% to 75% of sales were to ready-mixed concrete producers, 10% to concrete product manufactures, 8% to 10% to contractors, and 5% to 12% to other customer types. Texas, California, Missouri, Florida, Alabama, Michigan, and Pennsylvania were, in descending order of production, the seven leading cement-producing States and accounted for nearly 60% of U.S. production.

Events, Trends, and Issues

Construction spending decreased in 2019, owing to a decline in private residential and nonresidential spending. Cement shipments into North Carolina and South Carolina increased owing to reconstruction following a hurricane in 2018. The leading cement-consuming States were Texas, California, and Florida, in descending order by tonnage.

No new company mergers were reported in 2019, but one European cement company entered into an agreement to purchase a Mexican cement company’s plant in Pennsylvania, pending regulatory approval.

No major cement plant upgrades were completed during the year, but several minor upgrades were ongoing at a few domestic plants. One cement company began work on an upgrade to one of its plants in Indiana, with completion expected in 2022. Another company continued to work on securing permits for a new white cement plant in Texas, which would be the third white cement plant in the country.

Many plants have installed emissions-reduction equipment to comply with the 2010 National Emissions Standards for Hazardous Air Pollutants (NESHAP). It remains possible that some kilns could be shut, idled, or used in a reduced capacity to comply with NESHAP, which would constrain U.S. clinker capacity.

It was forecast that cement projection would rise over the last few years, reaching 100 million metric tons in the United States. This projection was supported by both residential and non-residential construction trends as well as an overall, positive economic impact. Under recent historical figures, it was found that domestic production of both Portland and masonry cement as well as cement clinker have mostly increased since the 2008 Recession, although not completely recovered.

The Future of Cement Market in United States report is a comprehensive analytical work on United States Cement markets. The research work strategically analyzes the United States market, assessing the future trends, drivers and challenges across multiple dimensions including growth, demand, pricing, competition, Infrastructure, regulatory policies and others.

The global cement market size is expected to reach USD 682.3 billion by 2025, expanding at a CAGR of 7.8% during the forecast period. The market is anticipated to register rapid growth due to growing infrastructural development across the globe.

The global infrastructure investment is dominated by countries such as India, China, and the U.S. Soaring need for infrastructure upgrade and modification in the U.S. is likely to fuel the demand for cement over the forecast period.

Demand for residential properties is growing due to increasing urbanization and rising household income. In addition, improving economic conditions in countries such as India and China is stimulating the demand for retail and commercial spaces. Both countries are estimated to observe a remarkable rise in establishments in urban areas over the forecast period, thus providing a fillip to the cement market.

- For Cement Market Size, Share, and Trends Analysis Report By Product (Portland, Others), By Application (Residential, Non-residential/Infrastructure), By Region, Vendor Landscape, And Segment Forecasts, 2018 – 2025 please click here.

FOB Prices for Clinker, Grey Cement, and White Cement/ per MT

Cement Clinker

$19

Portland Cement Clinker-Type II

Status: Fresh, and High-Quality

Standard: ASTM C-150

Delivery: FOB-BIK Port

Payment Terms: TT

Grey Cement

$36

Grey Cement-Type II

Status: Fresh, and High-Quality

Standard: ASTM C 150- Type II

Delivery: FOB-BIK Port

Payment Terms: TT

White Cement

$61

Portland White Cement-52,5

Status: Fresh, and High-Quality

Standard: EN 197-1, 52,5

Delivery: FOB-BND Port

Payment Terms: TT

Gypsum

Rock

$8

GYPSUM rock

Status: High-Quality

Standard: Purity 90-95%

Delivery: FOB-BND Port

Payment Terms: TT

CIF offer

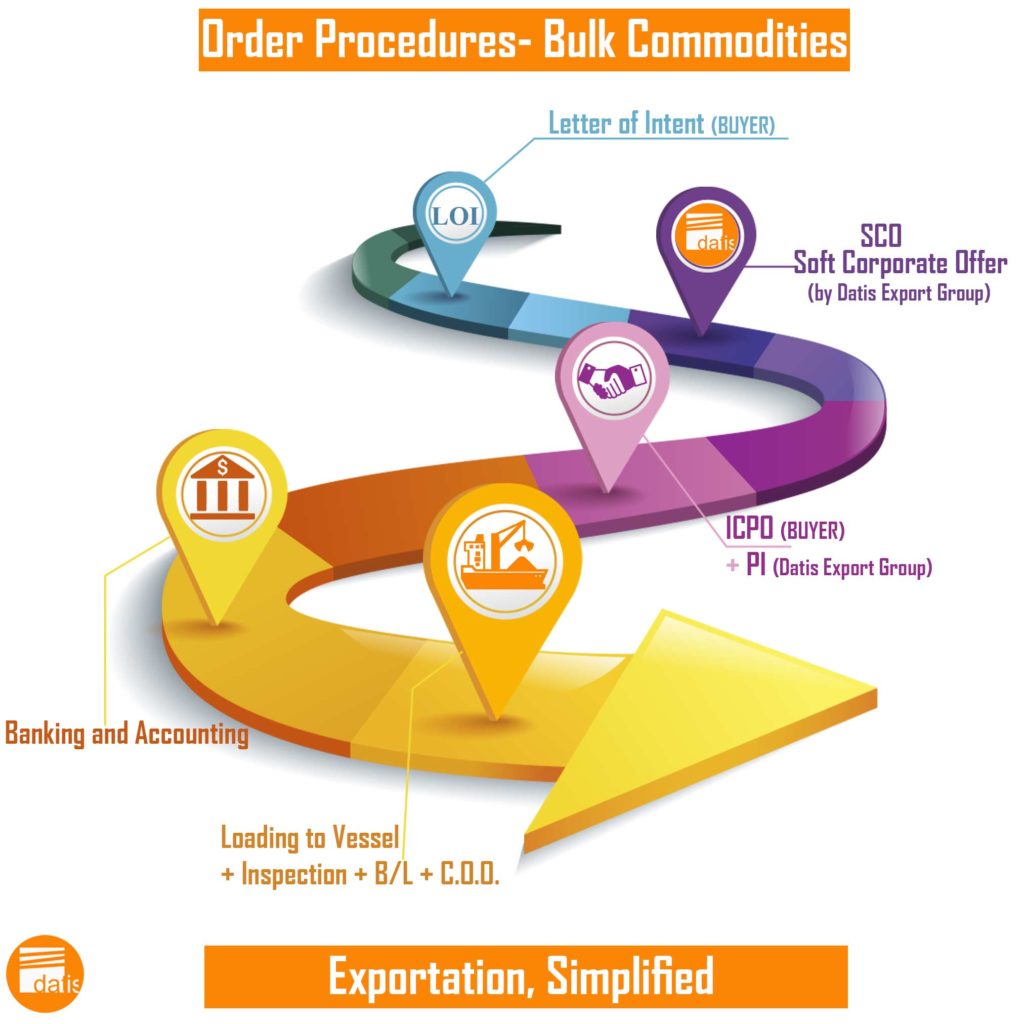

Letter of Intent-LOI in the first level

For CIF offer, our sales team should determine all details such as the product cost, transit to the port of loading, loading to the vessel (or stuffing), customs duties, etc.

we require to obtain accurate information on the inquiry as Letter of Intent-LOI in the first level. Please mail us LOI to our Sales Team.

We hope you find detailed information about the answer to the question of How many cement plants are producing in the USA 2020 in this article.

Datis Export Group supplies all types of Portland Cement (Grey, and White) and Cement Clinker. Our sales team will manage to export the Cement to any destination port for Bulk and Bagged containerized cargoes.

You can send us your cement inquiry by email to our sales office. Our branches will manage to supply and export the cement through the best-reputed cement factories in the region.