Top 10 cement companies in India 2020

Introduction

Cement is a very useful binding material in construction. The applications of cement over various fields of construction have made it a very important civil engineering material.

It is used in the construction of important engineering structures such as bridges, culverts, dams, tunnels, lighthouses etc.

Cement is mainly used as a binder in concrete, which is a basic material for all types of construction, including housing, roads, schools, hospitals, dams, and ports, as well as for decorative applications (for patios, floors, staircases, driveways, pool decks) and items like tables, sculptures or bookcases.

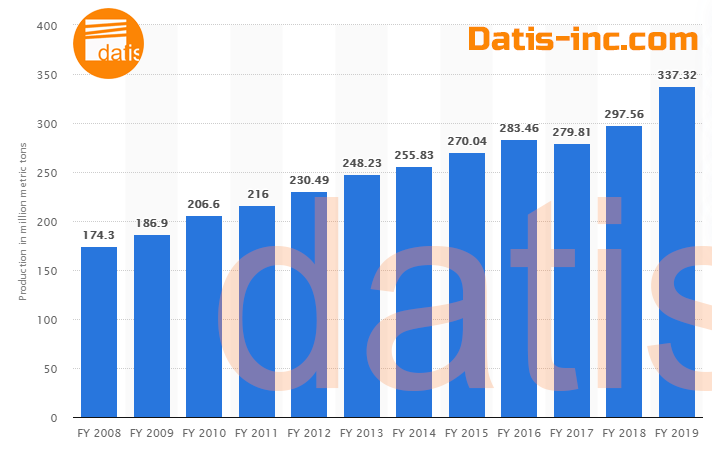

The production of cement in India

Started in 1889 by a company based in Kolkata. In the early nineteenth century, the industry started taking an organized stance and is currently, the second-largest producer of cement worldwide after China. The production volume of cement across the South Asian country was about 340 million metric tons in the financial year 2019. The sector encompasses a total of over 450 small and large cement plants.

Supply and demand

Within the country, the maximum demand was created by the housing sector, with a share of over 60 percent during the financial year 2017. The increased demand was a consequence of the government setting up an Affordable Housing Fund under the National Housing Bank, which helped the citizens get credits to buy homes. Outside the nation, Sri Lanka was the leading destination for cement clinker exports in 2016, with over one million metric tons of estimated exports.

Building together

To meet the increasing domestic and international demands, companies started to sign joint ventures.

In 2017, the number of mergers and acquisitions in the cement and building sector amounted to 14 deals. Due to its possibilities in composition in addition to be a binder, cement is a very precious commodity.

The top 10 cement companies in India

India is the second-largest producer of cement in the world. Ever since it was deregulated in 1982, the Indian cement industry has attracted huge investments, both from Indian as well as foreign investors.

The cement industry employs about 20,000 people across downstream sectors for every million tonnes of cement produced.

According to data released by the (DIPP), cement and (FDI) worth US$ 5.28 billion between April 2000 and March 2018.

As per IBEF, cement production capacity stood at 502 million tonnes per year (MTPA). Capacity addition of 20 million tonnes per annum (MTPA) is expected in FY2019 to FY2021. The cement industry is expected to reach 550-600 Million Tonnes Per Annum (MTPA) by the year 2025.

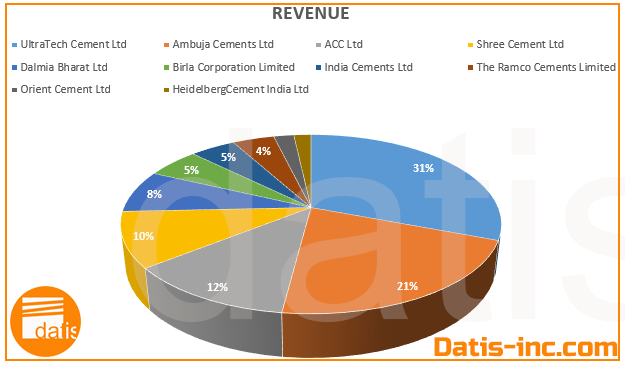

Revenue and Market share

- Here we can see the list of top 10 Companies in the Cement industry in India by revenue and Market share.

The real estate, construction, and infrastructure sectors are booming in India. Additionally, the government initiatives on the development of 98 smart cities are expected to provide a major boost to the sector.

Basically, the housing sector is the biggest demand driver of cement. The sector accounts for about 67% of the total consumption in India. The other major consumers of cement include infrastructure at 13%, commercial construction at 11%, and industrial construction at 9%.

As far as the production is concerned, the industry is growing at 5 to 6 %. However, the industry is highly dominated by a few large companies. Interestingly, the top 10 cement companies account for more than 50% of the total cement production in India.

A list of the Indian largest cement companies ranked by Revenue and Market Share

| Rank | Indian Cement Company | Revenue (Rs Cr) | Market share % |

| 1 | UltraTech Cement Ltd | 38,657 | 21.40 |

| 2 | Ambuja Cements Ltd | 26,646 | 6.20 |

| 3 | ACC Ltd | 15,398 | 6.00 |

| 4 | Shree Cement Ltd | 12,555 | 7.00 |

| 5 | Dalmia Bharat Ltd | 9,642 | 5.50 |

| 6 | Birla Corporation Limited | 6,778 | 3.20 |

| 7 | India Cements Ltd | 5,770 | 3.00 |

| 8 | The Ramco Cements Limited | 5,310 | 3.00 |

| 9 | Orient Cement Ltd | 2,570 | 1.60 |

| 10 | HeidelbergCement India Ltd | 2,182 | 1.10 |

Cement production volume in India from the financial year 2008 to 2019

UltraTech Cement Ltd

UltraTech Cement Ltd

is the largest manufacturer of grey cement, Ready Mix Concrete (RMC) and white cement in India. It is also one of the leading cement producers globally. Ultratech is the Largest among the top 5 cement companies in India . Ultra tech is the subsidiary of Grasim Industries which is owned by Aditya Birla Group.

- Revenue: Rs 38,657 Cr

- Production capacity: 102.75 MTPA

- Employees: 120,000

- Market Share: 21.4 %

The company has a consolidated capacity of 102.75 Million Tonnes Per Annum (MTPA) of grey cement. UltraTech Cement has 20 integrated plants, 1 clinkerisation plant, 26 grinding units, and 7 bulk terminals. It is the leading cement companies in India.

Its operations span across India, UAE, Bahrain, Bangladesh and Sri Lanka. UltraTech Cement is also India’s largest exporter of cement reaching out to meet the demand in countries around the Indian Ocean and the Middle East.

- Market Cap: 107,207 Cr.

- Stock P/E: 35.61

- Dividend Yield: 0.29 %

- ROCE: 10.22 %

- ROE: 8.58 %

- Sales Growth (3Yrs): 14.12 %

- Promoter holding: 61.68 %

- Debt to equity: 0.80

- Price to book value: 3.78

In the white cement segment, UltraTech goes to market under the brand name of Birla White. It has a white cement plant with a capacity of 0.56 MTPA and 2 WellCare putty plants with a combined capacity of 0.8 MTPA.

It employs a diverse workforce comprising of 120,000 employees, belonging to 42 different nationalities across 36 countries. It is the largest producer of cement in India based on turnover and market share.

Revenue percentage in Top 10 Cement Companies in INDIA 2020

Ambuja Cements Ltd

Ambuja Cements Ltd

a part of the global conglomerate LafargeHolcim, is among the Top 10 Cement Companies in India. It is the second-largest producer of cement in India based on turnover.

- Revenue: Rs 26,646 Cr

- Production capacity: 29.65 MTPA

- Employees: 5180

- Market Share: 6.2 %

Ambuja Cement has provided hassle-free, home-building solutions with its uniquely sustainable development projects and environment-friendly practices since it started operations. Ambuja cement is in the list of top 5 cement companies in India.

- Market Cap: 39,187 Cr.

- Stock P/E: 15.76

- Dividend Yield: 0.00 %

- ROCE: 15.03 %

- ROE: 10.59 %

- Sales Growth (3Yrs): 40.26 %

- Promoter holding: 63.11 %

- Debt to equity: 0.00

- Price to book value: 1.70

Currently, Ambuja Cement has a cement capacity of 29.65 million tonnes with five integrated cement manufacturing plants and eight cement grinding units across the country. The company also generated 7.4% of its power needs from renewable resources. The company produces one of the best quality cement in India.

ACC Ltd

ACC Limited

is one of India’s leading manufacturers of cement and ready-mix concrete with 17 cement factories, 75 ready mix concrete plants, over 6,700 employees, a vast distribution network of 50,000+ dealers & retailers and a countrywide spread of sales offices. It is the 3rd leading cement companies in India

- Revenue: Rs 15,398 Cr

- Production capacity: 28.4 MTPA

- Employees: 6731

- Market Share: 6%

ACC has consistently set benchmarks in cement and concrete technology since its inception in 1936. From the Bhakra Nangal Dam in 1960 to the Mumbai-Pune Expressway, ACC cement is at the foundation of iconic landmarks across the country.

- Market Cap: 27,886 Cr

- Stock P/E: 16.00

- Dividend Yield: 0.94 %

- ROCE: 16.06 %

- ROE: 15.28 %

- Sales Growth (3Yrs): 8.13 %

- Promoter holding: 54.53 %

- Debt to equity: 0.00

- Price to book value: 2.54

In 2005, ACC Limited became a part of the reputed Holcim Group of Switzerland. In 2015 Holcim Limited and Lafarge SA came together in a merger of equals to form LafargeHolcim – the new world leader in the building materials industry.

Shree Cement Ltd

Shree Cement Ltd

is the Fourth among the Top 10 Companies in Cement in terms of sales. Incorporated in 1979 by renowned Bangur family based out of Kolkata. Set-up the first Cement Plant in 1985 with an installed capacity of 0.6 Mtpa. Today Total Cement Capacity of the Company is 29.30 Million tons.

- Revenue: Rs 12,555 Cr

- Production capacity: 29.30 MTPA

- Employees: 6,299

- Market Share: 7 %

Came out with a Public Issue in the year 1984. Listed on National Stock Exchange (“NSE”) and Bombay Stock Exchange (“BSE”). The total no of employees in 1985 was around 100. Total No. of Employees as on 31st March 2017 was 6299. It is on the list of top 5 cement companies in India.

- Market Cap: 64,420 Cr.

- Stock P/E: 56.41

- Dividend Yield: 0.32 %

- ROCE: 12.61 %

- ROE: 12.30 %

- Sales Growth (3Yrs): 31.56 %

- Promoter holding: 64.79 %

- Debt to equity: 0.29

- Price to book value: 6.66

Dalmia Bharat Ltd

Dalmia Bharat Ltd

Is Fifth Among the Top 10 Companies in Cement by Total Revenue. The Company has a cement manufacturing plant in southern states of Tamil Nadu (Dalmiapuram & Ariyalur) and Andhra Pradesh (Kadapa), with a capacity of 9 million tonnes per annum.

- Revenue: Rs 9,642 Cr

- Production capacity: 26.5 MTPA

- Employees: 5,634

- Market Share: 5.5 %

A leader in cement manufacturing since 1939, DCBL is a multi-spectrum Cement player with double-digit market share and a pioneer in super-specialty cement used for Oil wells, Railway sleepers, and Airstrips. It is last in the list of top 5 cement companies in India.

- Market Cap: 16,343 Cr.

- Stock P/E: 40.15

- Dividend Yield: 0.24 %

- ROCE: 4.14 %

- ROE: 1.76 %

- Promoter holding: 54.26 %

- Debt to equity: 0.55

- Price to book value: 1.54

Dalmia holds a stake of 74 % in OCL India Ltd., a major cement player in the Eastern Region. Recently acquired the brands Adhunik Cement & Calcom Cement in North East. The group now controls an expandable capacity of 25 million tonnes.

Birla Corporation Limited

Birla

Is the flagship Company of the M.P. Birla Group. Incorporated as Birla Jute Manufacturing Company Limited in 1919, it was Late Mr. Madhav Prasad Birla, who gave shape to it. As Chairman of the Company, he transformed it from a manufacturer of jute goods into a leading multi-product corporation with widespread activities. It is one of the Top leading cement companies in India

- Revenue: Rs 6,778 Cr

- Production capacity: 15.5 MTPA

- Employees: 5,776

- Market Share: 3.2 %

Under the Chairmanship of Mrs. Priyamvada Birla, the Company crossed the Rs. 1,300 – crore turnover mark and the name was changed to Birla in 1998. Mr. Harsh V Lodha is now Chairman of the Company. It is sixth in the list of top 10 cement companies in India.

The Company is primarily engaged in the manufacturing of cement as its core business activity. It has a significant presence in the jute goods industry as well. The company produces one of the best quality cement in India.

- Market Cap: 4,307 Cr

- Stock P/E: 13.79

- Dividend Yield: 1.34 %

- ROCE: 8.02 %

- ROE: 5.70 %

- Sales Growth (3Yrs): 26.07 %

- Promoter holding: 62.90 %

- Debt to equity: 0.90

- Price to book value: 0.96

The Company has acquired 100% shares of Reliance Cement Company Private Limited (Reliance Cement), a subsidiary of Reliance Infrastructure Limited (RIL). After this acquisition, Reliance Cement has become a wholly-owned material subsidiary of the company. The entire cement business of RIL has been acquired for an Enterprise Value of Rs. 4,800 crores. This acquisition provides the ownership of high-quality assets, taking its total capacity from 10 MTPA to 15.5 MTPA.

India Cements Ltd

India Cements Ltd

was founded in the year 1946 by two men, Shri S N N Sankaralinga Iyer and Sri T S Narayanaswami. They had the vision to inspire dreams for an industrial India, the ability to translate those dreams into reality and the ability to build enduring relationships and the future.

- Revenue: Rs 5,770 Cr

- Production capacity: 15 MTPA

- Employees: 4300

- Market Share: 3

From a two plant company having a capacity of just 1.3 million tonnes in 1989, India Cements has robustly grown in the last two decades to a total capacity of 15.5 million tonnes per annum. It is seventh in the list of top 10 cement companies in India.

- Market Cap: 2,462 Cr.

- Stock P/E: 123.54

- Dividend Yield: 10.07 %

- ROCE: 4.62 %

- ROE: 0.38 %

- Sales Growth (3Yrs): 5.75 %

- Promoter holding: 28.21 %

- Debt to equity: 0.65

- Price to book value: 0.47

India Cements has now 8 integrated cement plants in Tamil Nadu, Telangana, Andhra Pradesh, and Rajasthan and two grinding units, one each in Tamil Nadu and Maharashtra.

The Ramco Cements Limited

The Ramco Cements Limited

Is the flagship company of the Ramco Group, a well-known business group of South India. It is headquartered in Chennai. It is eight in the list of top 10 cement companies in India.

- Revenue: Rs 5,310 Cr

- Production capacity: 16 MTPA

- Employees: 3034

- Market Share: 3

The main product of the company is Portland cement, manufactured in eight state-of-the-art production facilities that include Integrated Cement plants and Grinding units with a current total production capacity of 16.45 MTPA. The company is the fifth largest cement producer in the country.

- Market Cap: 17,090 Cr.

- Stock P/E: 29.83

- Dividend Yield: 0.41 %

- ROCE: 13.64 %

- ROE: 11.87 %

- Sales Growth (3Yrs): 12.93 %

- Promoter holding: 42.75 %

- Debt to equity: 0.36

- Price to book value: 3.83

It is the most popular cement brand in South India. The company also produces Ready Mix Concrete and Dry Mortar products and operates one of the largest wind farms in the country.

Orient Cement Ltd

Orient Cement Ltd

Established in 1979, Orient Cement was formerly, a part of Orient Paper & Industries. It emerged in the year 2012 and since then, it has emerged as one of the fastest-growing and leading cement manufacturers in India.

- Revenue: Rs 2,570 Cr

- Production capacity: 8 MTPA

- Employees: 1500

- Market Share: 1.6 %

Orient Cement began cement production in the year 1982 at Devapur in Adilabad District, Telangana. In 1997, a split-grinding unit was added at Nashirabad in Jalgaon, Maharashtra. It is ninth in the list of top 10 cement companies in India.

- Market Cap: 1,838 Cr.

- Stock P/E: 21.02

- Dividend Yield: 0.84 %

- ROCE: 8.26 %

- ROE: 4.58 %

- Sales Growth (3Yrs): 19.92 %

- Promoter holding: 37.36 %

- Debt to equity: 1.22

- Price to book value: 1.74

In 2015, Orient Cement started commercial production at its integrated cement plant located at Chittapur, Gulbarga, Karnataka. With a total capacity of 8 MTPA, they serve Maharashtra, Telangana, Andhra Pradesh, Karnataka, and parts of Madhya Pradesh, Tamil Nadu, Kerala, Gujarat, and Chhattisgarh.

HeidelbergCement India Ltd

HeidelbergCement India Limited

Is a subsidiary of HeidelbergCement Group, Germany. The Company has its operations in Central India at Damoh (Madhya Pradesh), Jhansi (Uttar Pradesh), and in Southern India at Ammasandra (Karnataka).

- Revenue: Rs 2,182 Cr

- Production capacity: 5.4 MTPA

- Employees: 1100

- Market Share: 1.1 %

The Company increased its capacity to 5.4 million tonnes p.a. Through Brownfield expansion of its facilities in Central India in 2013. It is 10th in the list of top 10 cement companies in India.

- Market Cap: 4,357 Cr.

- Stock P/E: 17.53

- Dividend Yield: 2.08 %

- ROCE: 24.83 %

- ROE: 19.90 %

- Sales Growth (3Yrs): 8.98 %

- Promoter holding: 69.39 %

- Debt to equity: 0.44

- Price to book value: 3.72

The new manufacturing capacity has enabled the Company to increase its market share in Central India i.e. Madhya Pradesh and Uttar Pradesh and in markets of Bihar, Haryana, and Uttarakhand.

China produces the most cement globally by a large margin, at an estimated 2.2 billion metric tons in 2019, followed by India at 320 million metric tons in the same year.

Top Countries by Cement Production 2020

Rank | Country | Cement Production (Mt) |

1 | China | 2500 |

2 | India | 280 |

3 | USA | 83.3 |

4 | Iran | 75 |

5 | Turkey | 75 |

6 | Brazil | 72 |

7 | Russia | 69 |

8 | Saudi Arabia | 63 |

9 | Vietnam | 60 |

10 | Indonesia | 60 |

Source: USGS Mineral Survey

The Future of the India Cement Industry

India’s cement production capacity is expected to reach 550 MT by 2025.

Due to the increasing demand in various sectors such as housing, commercial construction, and industrial construction, the cement industry is expected to reach 550-600 million tonnes per annum (MTPA) by the year 2025.

We hope you find detailed information about the Top 10 cement companies in India 2020 in this article.

Datis Export Group supplies all types of Portland Cement (Grey, and White) and Cement Clinker. Our sales team will manage to export the Cement to any destination port for Bulk and Bagged containerized cargoes.

You can send us your cement inquiry by email to our sales office. Our branches will manage to supply and export the cement through the best-reputed cement factories in the region.

FOB Prices for Clinker, Grey Cement, and White Cement/ per MT

Cement Clinker

$18

Portland Cement Clinker-Type II

Status: Fresh, and High-Quality

Standard: ASTM C-150

Delivery: FOB-BIK Port

Payment Terms: TT

Grey Cement

$34

Grey Cement-Type II

Status: Fresh, and High-Quality

Standard: ASTM C 150- Type II

Delivery: FOB-BIK Port

Payment Terms: TT

White Cement

$59

Portland White Cement-52,5

Status: Fresh, and High-Quality

Standard: EN 197-1, 52,5

Delivery: FOB-BND Port

Payment Terms: TT

Gypsum

Rock

$8

GYPSUM rock

Status: High-Quality

Standard: Purity 90-95%

Delivery: FOB-BND Port

Payment Terms: TT

CIF offer

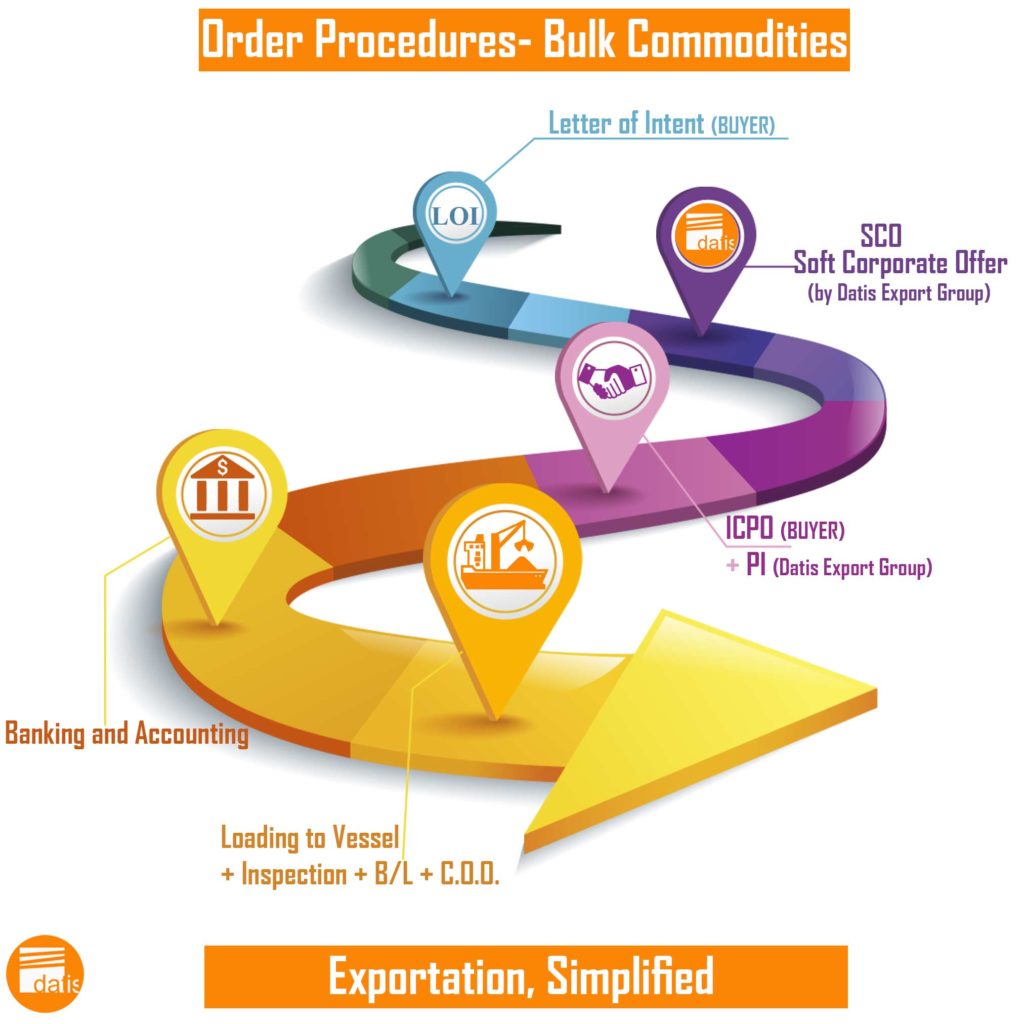

Letter of Intent-LOI in the first level

For CIF offer, our sales team should determine all details such as the product cost, transit to the port of loading, loading to the vessel (or stuffing), customs duties, etc.

we require to obtain accurate information on the inquiry as Letter of Intent-LOI in the first level. Please mail us LOI to our Sales Team.